Key Techniques in Bookkeeping 8447297017

Effective bookkeeping is foundational to any successful business operation. It involves meticulous categorization of transactions and maintaining accurate records. The implementation of key techniques can significantly enhance financial integrity and decision-making. Furthermore, the integration of modern tools can streamline these processes, yet many organizations overlook best practices. Understanding these nuances is essential for fostering sustainable growth and operational efficiency. Exploring these aspects reveals the critical elements that can transform financial management.

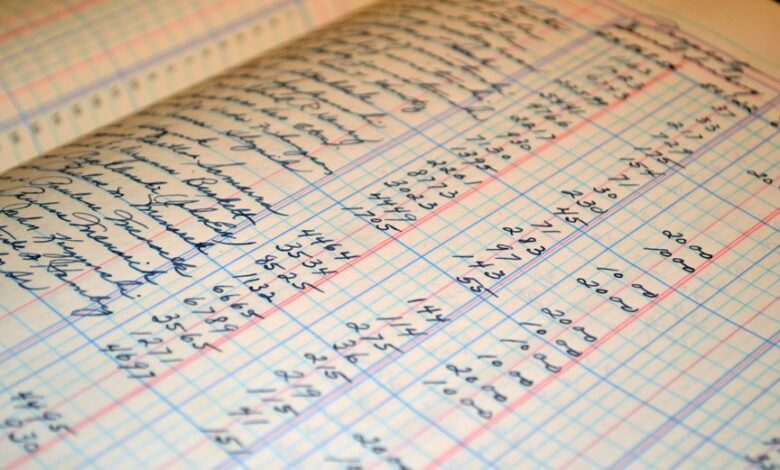

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundational framework for effective financial management within a business.

Understanding the bookkeeping fundamentals is crucial for accurate financial recordkeeping. This discipline ensures that all monetary transactions are systematically documented, providing clarity and transparency.

Mastery of these basics empowers individuals to maintain control over their financial landscape, fostering a sense of autonomy and informed decision-making in their business endeavors.

Essential Bookkeeping Techniques for Accuracy

Accurate financial recordkeeping is critical for any business seeking to thrive in a competitive landscape.

Essential techniques include diligent transaction categorization and consistent record keeping. By systematically organizing financial data, businesses ensure precise reporting and facilitate informed decision-making.

Implementing these practices not only enhances operational efficiency but also empowers organizations to maintain financial integrity, ultimately fostering growth and sustainability in a dynamic market.

Tools and Software for Efficient Bookkeeping

An array of tools and software solutions is available to enhance the efficiency of bookkeeping processes.

Cloud solutions offer flexibility and accessibility, allowing users to manage financial data remotely.

Meanwhile, automated processes reduce manual input, minimizing errors and saving time.

Together, these technologies empower businesses to streamline their bookkeeping functions, fostering an environment where financial freedom and accuracy coexist seamlessly.

Best Practices for Financial Reporting and Analysis

Financial reporting and analysis serve as critical components in the decision-making framework of any organization.

Adopting best practices, such as regularly calculating financial ratios and implementing robust budget forecasting, enhances transparency and strategic insight.

This disciplined approach not only aids in evaluating financial health but also empowers stakeholders to make informed decisions, ultimately fostering organizational resilience and financial autonomy.

Conclusion

In conclusion, the cornerstone of effective bookkeeping lies in the meticulous application of essential techniques, which serve as the bedrock for accurate financial management. By harnessing modern tools and adhering to best practices, businesses can navigate the intricate landscape of financial reporting with confidence. Just as a well-tuned instrument produces harmonious melodies, so too does diligent bookkeeping foster clarity and precision in financial decision-making, ultimately paving the way for sustained organizational growth and integrity.