Key Concepts in Bookkeeping 8443472955

The fundamental principles of bookkeeping, including debits and credits, are essential for accurate financial reporting. These concepts underpin the double-entry accounting system, ensuring integrity in transaction recording. Financial statements play a critical role in evaluating organizational performance. Moreover, effective cash flow management is vital for sustainability. Understanding these key elements can significantly impact decision-making processes. This raises the question: how can mastery of these concepts influence long-term organizational success?

Understanding Debits and Credits

A fundamental aspect of bookkeeping is the understanding of debits and credits, which serve as the backbone of the double-entry accounting system.

In this framework, a debit journal records increases in assets or expenses, while a credit balance indicates increases in liabilities or equity.

Mastery of these concepts is essential for maintaining accurate financial records and ensuring organizational transparency and autonomy.

The Importance of Financial Statements

Financial statements play a critical role in providing a comprehensive overview of an organization’s financial health.

They serve as essential tools for performance analysis, enabling stakeholders to assess profitability, liquidity, and overall stability.

Accurate financial statements facilitate informed decision-making, fostering transparency and accountability.

Consequently, they empower organizations to navigate financial landscapes effectively, ensuring long-term viability and operational success.

Recording Transactions Accurately

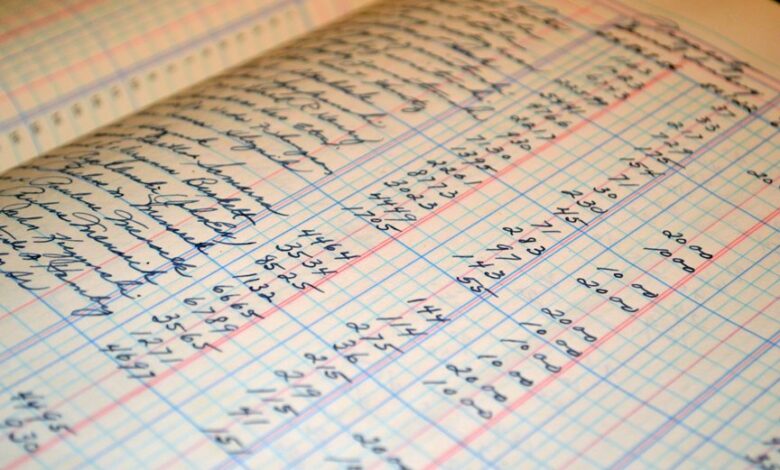

Accurate recording of transactions serves as the backbone of effective bookkeeping practices.

Different transaction types require specific documentation processes to ensure clarity and compliance.

By meticulously categorizing each entry, businesses can maintain transparency and facilitate informed decision-making.

This precision not only enhances financial integrity but also grants stakeholders the freedom to analyze performance and strategize for future growth effectively.

Managing Cash Flow Effectively

While businesses strive for growth, managing cash flow effectively remains crucial for sustaining operations and ensuring long-term viability.

Effective cash management involves implementing budgeting strategies to forecast income and expenses accurately.

By prioritizing cash flow analysis, businesses can identify potential shortfalls, allocate resources efficiently, and enhance financial flexibility.

This proactive approach empowers organizations to navigate economic uncertainties while promoting sustainable growth and operational resilience.

Conclusion

In conclusion, mastering key concepts in bookkeeping is vital for organizational success. A striking statistic reveals that approximately 60% of small businesses fail due to poor financial management, underscoring the necessity of accurate record-keeping and cash flow management. By understanding debits and credits, the significance of financial statements, and the importance of precise transaction recording, stakeholders can enhance decision-making capabilities and bolster long-term viability. Effective bookkeeping practices ultimately serve as the backbone of sustainable business operations.