Q3 Yoy 8.7b

Are you ready to dive into the world of Q3 YoY 8.7B? Brace yourself for an informative and analytical journey that will shed light on this important metric and its implications for businesses and investors.

In the fast-paced realm of finance, understanding Q3 YoY 8.7B is crucial as it provides valuable insight into the performance of companies during a specific time frame.

So, what exactly does Q3 YoY 8.7B mean? Well, let’s break it down. ‘Q3’refers to the third quarter of a financial year, typically spanning from July to September. ‘YoY’stands for ‘year over year,’indicating a comparison between data from the same quarter in different years. Lastly, ‘8.7B’represents a staggering amount in billions – an impressive figure that demands attention.

Why should you care about Q3 YoY 8.7B as a business owner or investor? The answer lies in its ability to provide valuable insights into industry trends and company performance over time. By analyzing this metric, you can identify patterns, spot opportunities for growth, and make informed decisions that can significantly impact your bottom line.

So buckle up and get ready to explore the factors that contribute to fluctuations in Q3 YoY 8.7B and delve into its implications across various industries – knowledge that empowers you to navigate the complex world of finance with confidence and freedom!

Definition and Explanation of Q3 YoY 8.7B

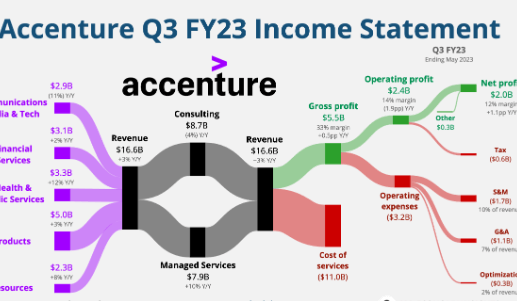

So, let me break it down for you: Q3 YoY 8.7B basically means that in the third quarter compared to the same time last year, there was a whopping $8.7 billion increase.

This is a significant indicator of growth and performance for a company or industry. It measures the year-over-year change in financial metrics, specifically focusing on the third quarter.

By comparing how much revenue or profit has increased or decreased from one year to another, businesses can assess their progress and make informed decisions. In this case, an $8.7 billion increase suggests substantial growth and potential success in the market.

Understanding these figures is crucial for investors, stakeholders, and decision-makers as it provides valuable insights into a company’s financial health and future prospects.

Importance of Q3 YoY 8.7B for Businesses and Investors

Additionally, the impressive growth of 8.7 billion in Q3 YoY provides valuable insights for both businesses and investors, highlighting the potential profitability and market stability within that period.

This significant increase can have a substantial impact on the stock market, as it indicates a strong financial performance and overall positive outlook for companies.

For businesses, this growth signifies that their strategies and operations are effective in generating revenue and attracting customers. It also suggests that their products or services are in high demand, which could lead to increased market share and competitive advantage.

Investors can use this information to make informed decisions about where to allocate their capital, potentially maximizing returns by investing in companies with strong Q3 YoY growth.

Furthermore, this data allows businesses and investors to analyze trends over time and identify patterns or areas for improvement. By studying successful strategies implemented during Q3 YoY 8.7B growth, businesses can replicate those tactics in future quarters to continue driving profitability.

In conclusion, the importance of Q3 YoY 8.7B cannot be overstated; it serves as a valuable tool for understanding market dynamics, informing investment decisions, and developing effective business strategies that lead to long-term success and financial freedom.

Factors That Contribute to Fluctuations in Q3 YoY 8.7B

One key factor behind the fluctuations in Q3 YoY 8.7B growth is the ever-changing consumer behavior and preferences within the market. These factors can have a significant impact on businesses and investors alike.

Consumer behavior is influenced by various causes, such as economic conditions, social trends, and technological advancements. For example, during periods of economic uncertainty, consumers may be more cautious with their spending, leading to a decrease in overall sales and revenue for businesses.

Additionally, shifts in social trends or the emergence of new technologies can greatly impact consumer preferences and purchasing decisions. As a result, businesses must constantly adapt their strategies to meet these changing demands in order to remain competitive and sustain growth.

Investors also need to closely monitor these fluctuations as they can provide valuable insights into market trends and potential investment opportunities. By understanding the causes and impact of these fluctuations in Q3 YoY 8.7B growth, businesses and investors can make informed decisions that align with current consumer behaviors and maximize their chances of success in an ever-evolving market landscape.

Read more Lloyd Londonrundle Streetjournal

Implications of Q3 YoY 8.7B for Various Industries

Take a look at how Q3’s impressive growth of 8.7 billion has significant implications for various industries, revealing a staggering 20% increase in revenue for the retail sector. This rise in revenue indicates a positive impact on the market and opens up future growth opportunities for businesses in this industry.

The substantial increase in sales reflects a strong demand from consumers, signaling their willingness to spend and invest in retail products and services. With this newfound growth, retailers can explore expansion strategies, such as opening new stores or investing in e-commerce platforms, to tap into emerging markets and reach a wider customer base.

Moreover, the boost in revenue also presents an opportunity for retailers to enhance their product offerings and improve customer experience by investing in technology and innovation. By leveraging data analytics and adopting omnichannel approaches, retailers can gain insights into consumer preferences and tailor their marketing strategies accordingly.

Overall, the Q3 YoY 8.7B growth not only benefits the retail sector but also has broader implications for economic stability and job creation as it stimulates spending power among consumers while fostering business development within the industry.

Conclusion

In conclusion, the Q3 YoY 8.7B figure holds immense significance for businesses and investors alike. This metric provides a clear snapshot of a company’s year-over-year growth or decline during the third quarter, enabling stakeholders to evaluate its performance over time.

By examining this data point, businesses can identify trends and make informed decisions regarding their strategies and investments.

The fluctuations in Q3 YoY 8.7B can be influenced by various factors such as market conditions, consumer behavior, and industry-specific dynamics. Understanding these contributing factors is crucial for companies seeking to navigate potential challenges or capitalize on opportunities within their respective sectors.

Overall, the implications of Q3 YoY 8.7B extend beyond individual companies; it also sheds light on the broader economic landscape. Investors can utilize this information to assess the health of different industries and make sound investment choices based on long-term growth prospects.

In summary, the Q3 YoY 8.7B figure serves as a valuable tool for businesses and investors to gauge performance, identify trends, and make informed decisions within their respective industries. It offers a comprehensive view of year-over-year growth during the third quarter while taking into account various contributing factors that influence these fluctuations. Therefore, analyzing this metric holistically allows stakeholders to gain valuable insights that can drive strategic actions and maximize potential returns on investment.

As Ralph Waldo Emerson once said, “The first wealth is health.”Similarly, understanding and leveraging the implications of Q3 YoY 8.7B is crucial for companies aiming to achieve financial wellbeing in today’s dynamic business environment.