Robinhood 1.1b October Streetjournal

In October 2023, Robinhood’s latest Streetjournal report revealed pivotal insights into the company’s performance metrics and user engagement strategies amidst a volatile market environment. With an emphasis on democratizing trading through innovative features, Robinhood seeks to attract a wider audience of retail investors while navigating regulatory challenges. The implications of these developments on the overall landscape of retail trading warrant a closer examination, particularly as the company’s financial health indicators signal a potentially transformative trajectory. What remains to be seen is how these initiatives will reshape the future of investment for everyday users.

Key Performance Metrics

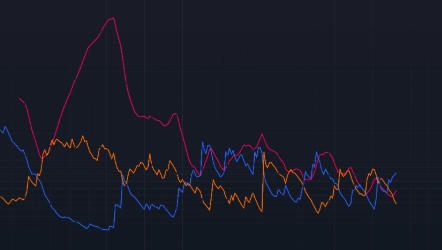

As Robinhood navigates the complexities of the financial landscape, its key performance metrics serve as crucial indicators of the platform’s operational health and market position.

An effective evaluation of user acquisition strategies reveals trends in customer growth, while revenue growth analysis highlights financial sustainability.

These metrics collectively inform stakeholders about Robinhood’s competitive edge and its ability to adapt in an evolving market.

User Engagement Trends

User engagement trends on the Robinhood platform provide valuable insights into user behavior and satisfaction, reflecting the overall health of the service.

Enhanced app features have positively influenced user retention, creating a more interactive experience.

Analysis reveals that consistent updates and user-centric designs foster loyalty, encouraging traders to engage regularly.

Understanding these trends is essential for optimizing the platform’s offerings and sustaining growth.

See also: Robinhood 10B Smithbloomberg

Impact on Retail Trading

The rise of platforms like Robinhood has fundamentally transformed the landscape of retail trading, democratizing access to financial markets for a broader audience.

This shift has altered retail investor behavior, leading to increased participation and a thirst for financial knowledge.

Moreover, intensified trading app competition has driven innovation, enhancing user experiences and empowering individuals to take control of their investment strategies like never before.

Conclusion

In summary, Robinhood’s recent advancements serve as a beacon in the tumultuous waters of the financial landscape. By prioritizing user engagement and expanding its offerings, the platform fosters a more inclusive trading environment. The commitment to educational initiatives and user-centric design not only empowers retail investors but also positions Robinhood for sustained growth amid regulatory challenges. This strategic navigation reflects an evolving narrative, where innovation and accessibility intertwine, shaping the future of retail trading.